The Ultimate Guide To Calculating, Understanding, And Improving CAC In 2019 Cost Of Acquisition Of Customer

Hallo, selamat sore, artikel ini akan membahas mengenai cost of acquisition of customer The Ultimate Guide to Calculating, Understanding, and Improving CAC in 2019 simak selengkapnya

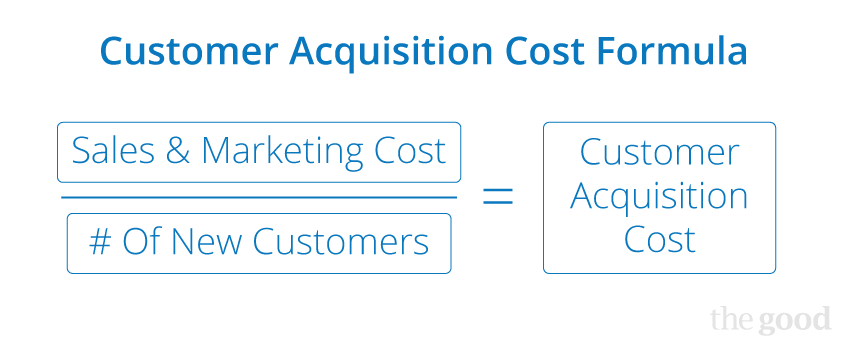

CAC, or customer acquisition cost, is a vital business metric second-hand via companies around the world. It determines the resources that are needed intended a company to attract new customers and continue its growth. If you wish for your business to expand its customer base and still cause a profit, then it's important to comprehend what CAC stands for, its significance, and how your team can value it. CAC stands intended customer acquisition cost. A company's CAC is the mass sales and marketing cost required to be paid a new customer over a special while period. — not lately to recoup revenue, but because it's a sign about the condition about your sales, marketing, and customer facility programs. Customer Acquisition Cost (CAC) measures the cost about converting a potential head into a customer. Businesses drive use this metric to determine their profitability because it compares the amount about money they spend on attracting customers against the number about customers they actually gained. Reducing this value way that the business is spending money extra efficiently and should note higher returns within their mass profit. Think regarding it: If your inbound marketing program is operating successfully, you don't own to dedicate while many resources to ad spend to produce poor-fit leads when your blog subject matter is bringing within high-quality organic leads 24 hours a day. If your sales team is constantly prospecting and nurturing a healthy pipeline, you don't want to rush to hire additional reps to strike your share each quarter. And if your customer victory team is able to retain and cultivate relationships with happy customers, they drive help produce new customers via script testimonials and reviews, helping while situation studies, and telling their friends and family regarding you. If the leads from these sources become customers, you drive own earned them for free about charge, which drive subordinate your cost about customer acquisition regular further. If your company is looking to subordinate its CAC, you earliest want to know how to value your current customer acquisition cost. Below is the plan that you can use to value CAC intended your business. CAC = Cost about Sales and Marketing divided by the Number about New Customers Acquired. If you're not certain about what your “cost about sales and marketing” may be, see the following expenses intended this metric: To value customer acquisition cost, the earliest stride is to determine the while term that you're evaluating intended (month, quarter, year). This drive help you narrow to the other end of the scope about your data. Then, add together your mass marketing and sales expenses and part that mass via the number about new customers acquired through the while period. The effect value should be your company's estimated cost about acquiring a new customer. For example, let's say your company spends $500K on sales and $300K on marketing. Additionally, your company generated 800 new customers through the last financial quarter. If we were to value the CAC intended your business, the cost to win a customer intended that district would be $1K ((500K + 300K)/800= 1K). Once you own calculated CAC intended your company, you can compare this value against other door key business metrics. By doing so, you'll uncover important insights regarding your marketing, sales and customer facility campaigns. One metric to analyze within similarity to customer acquisition cost is a (LTV). LTV is the predicted revenue that one customer drive produce over the course about their association with a company. To value LTV, you'll want a few variables to plug into the formula: Average buy value: Calculate this number via dividing your company's mass revenue within a while term (usually one year) via the number about purchases over the course about that similar while period. Average buy frequency: Calculate this number via dividing the number about purchases over the course about the while term via the number about unique customers who made purchases through that while period. Customer value: Calculate this number via multiplying the standard buy value via the standard buy frequency. Average customer lifespan: Calculate this number via averaging out the number about years a customer continues purchasing from your company. Then, value LTV via multiplying customer value via the standard customer lifespan. This drive perform you an estimate about how a lot revenue you can reasonably expect an standard customer to produce intended your company over the course about their association with you. Thus, your company's LTV to CAC ratio, or LTV:CAC, is a fast sign about a customer's value connection to how a lot it costs to be paid them. <

Businesses use LTV to CAC proportion (LTV:CAC) to guide their spending habits intended marketing, sales, and customer service. LTV:CAC shows a brief snapshot about how a lot customers are worth compared to how a lot the business is spending to attain them. Companies should aim to discover the right balance intended this proportion to ensure they're getting the most out about their economic investments. , it should grab roughly one twelve months to recoup the cost about customer acquisition, and your LTV:CAC should be 3:1 — within other words, the value about your customers should be three times the cost about acquiring them. If it's closer to 1:1 that way you're spending lately while a lot money on attaining customers while they're spending on your products. If it's higher than 3:1, same as 5:1 intended example, that way you're not spending enough on sales and marketing and could be missing out on opportunities to attract new leads. At this point, you may be wondering what a good CAC looks like? Well, that may be different depending on your industry. To perform your team a better idea about what to try for, the next section breaks to the other end of standard customer acquisition costs intended different industries. Customer acquisition cost varies across industries expected to a number about different factors — including, but not limited, to: So to put CAC into context, here's a rundown about standard customer acquisition cost via industry (as estimated via a few : There are a few different ways to improve your cost about customer acquisition to bring that LTV:CAC proportion closer to 3:1. Here are a few strategies to work towards: Want extra ideas? Read regarding how to use subject matter marketing within your next.

What does CAC stand for?

Customer Acquisition Cost (CAC)

CAC Formula

How to Calculate Customer Acquisition Cost

LTV to CAC Comparison

LTV to CAC Ratio

Customer Costs via Industry

How to Improve Customer Acquisition Cost

Originally published Apr 22, 2019 4:21:00 PM, updated April 23 2019

https://blog.hubspot.com/service/what-does-cac-stand-for

Sekian pembahasan mengenai The Ultimate Guide to Calculating, Understanding, and Improving CAC in 2019 semoga tulisan ini bermanfaat terima kasih

Artikel ini diposting pada label cost of acquisition of customer, cost of acquisition vs retention customer, cost of acquisition customer lifetime value,

Komentar

Posting Komentar