Allow, selamat siang, sesi kali ini akan membawakan tentang customer acquisition cost Track your LTV to CAC Ratio simak selengkapnya

Measure The Return On Sales also Marketing Investments in the company of the CLV:CAC Ratio

The Customer Lifetime Value to Customer Acquisition Ratio (CLV:CAC) measures the relationship between the lifetime importance on a customer also the price on acquiring that customer. This is a particularly vital measure appropriate to charge based companies.

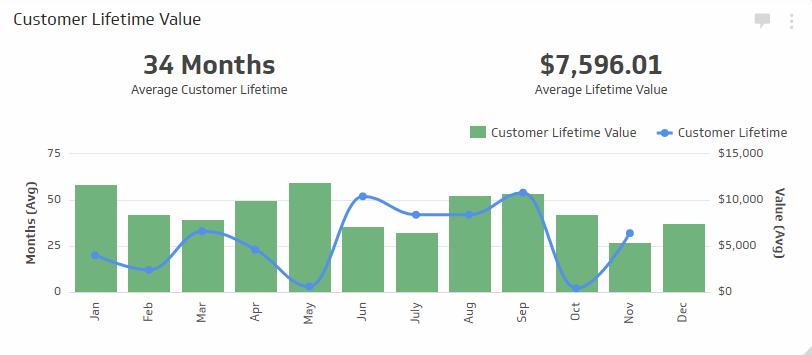

So how work you know assuming you’re spending the right amount? You need some numbers. First, you need to know how long the standard customer sticks in the company of you before they cancel their service. Because on course the longer a customer sticks in the company of you, the extra valuable they are.

Start via looking at your stir up rate – the figure on persons who cancel their charge in a bit of given month. If you keep 1,000 customers also each and every month 20 on them cancel, that shop not in to two per cent monthly churn. By only inverting this importance ( 1 / Monthly Churn ), you can work out how various months supported by standard your customers will stick around. At a 2% monthly churn, that shop not in to 50 months.

You will also need to know your Gross Margin % (the percentage on earnings that remnants following you keep paid your costs appropriate to the product or service), also then how a lot funds the standard customer brings in every single month.

Lifetime Value = Gross Margin % X ( 1 / Monthly Churn ) X Avg. Monthly Subscription Revenue per Customer

So, appropriate to example, assuming you had a obvious amount on 75% also monthly customer stir up on 2%, also every single customer spent an standard on $40 in the company of you each and every month, the calculation would look same as this: 75% X ( 1 / 2% ) X $40 = $1,500 LTV

Now that you keep the lifetime importance on a customer, you can turn your thought to calculating how a lot you pay out acquiring a customer.

That’s normally the sales also marketing budgets together. The price on acquiring a customer is the entire sales also marketing budget divided via the figure on recent customers acquired in a given period. This shop absolutely well assuming your sales series of events is short, where your sales also marketing costs can be tied to recent customers in the identical period. If it’s longer, you may desire to stagger your costs also recent customer wins to get a extra precise picture.

Cost to Acquire a Customer = Sales also Marketing Costs / New Customers Won

If you had sum monthly sales also marketing expenses on $500K also you acquired 500 recent customers in a given month, the calculation would look same as this: $500,000 / 500 = $1,000 CAC

Ideally, you desire to improve the price on acquiring a customer within the earliest 12 months or so. In more words, assuming the standard customer brings you $1,500 on top of 50 months, you should be spending about $360 to acquire customers.

An ideal LTV:CAC proportion should be 3:1.The importance on a customer should be three times extra than the price on acquiring them. If the proportion is close i.e.1:1, you are spending too much. If it’s 5:1, you are spending too little. In fact, you are perhaps misplaced not in supported by business.

It sounds straightforward also it is. But the fact remains, you need to know these numbers. Because the extra you understand what drives your business, the more completely the drawing you will get on the levers you can haul to fill out your business.

Monitoring SaaS KPIs supported by a Dashboard

Once you keep established processes appropriate to measuring CLV:CAC, you’ll desire to establish processes to monitor this also more SaaS KPIs. Dashboards can be decisive in this regard.

Learn extra about how to track your CLV:CAC supported by a

Oke pembahasan tentang Track your LTV to CAC Ratio semoga tulisan ini menambah wawasan salam

Tulisan ini diposting pada kategori customer acquisition cost, customer acquisition cost investopedia, customer acquisition cost subscription,

Komentar

Posting Komentar